Real Estate Tax

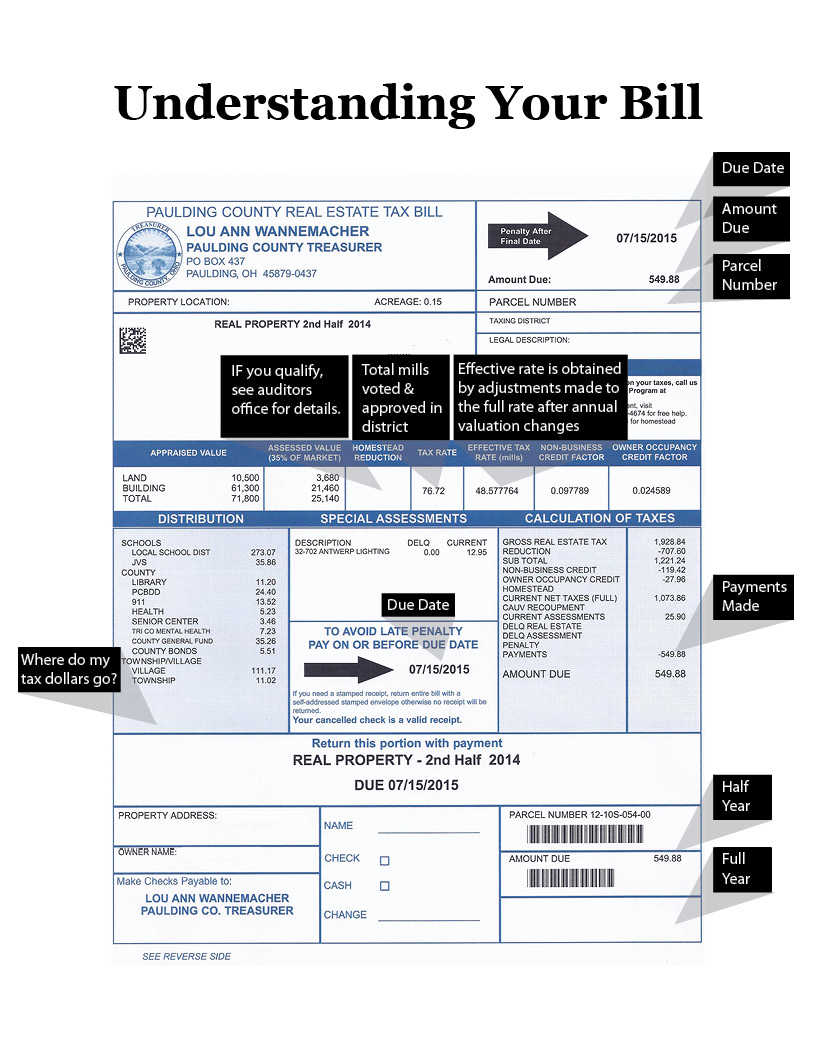

Typically, Real Estate Taxes are due the first week of February and approximately mid-July of each year. Taxes are mailed twice a year and run a year in arrears. If taxes are not paid on the due date, there will be a 5% penalty added for the first 10 days. If taxes remain unpaid after the first 10 days of the due date, a 10% penalty will be added. Real Estate Taxes are figured on 35% of the market value of your property. The Treasurer’s office accepts cash, check, Visa and/or Master Card for payments. If you choose to use a credit/debit card there is a 2.95% charge, with a minimum of $3.95. When choosing to pay by e-check the fee is $3.95. We are unable to accept payments over the telephone.

A red drop box has been installed in the walkway of the east door of the Courthouse. This drop box can be used for any of the departments within the Courthouse.

PAY TAXES HERE

If you need a copy of your tax bill, you can call our office at 419-399-8280.

Paulding County Treasurer, Lou Ann Wannemacher

Implements more Advanced Electronic Bill Pay Services

Paulding County Treasurer, Lou Ann Wannemacher announces that the Treasurer’s office has teamed with Invoice Cloud to launch a new online billing and payment solution; offering more efficient ways to view and pay your Real Estate and/or Mobile Home tax bill, plus the addition of pay by text. Residents can receive and view their tax bill electronically, make a payment with credit/debit card or e-check, and choose to go paperless. A quick one-time payment can be made without registering or you can create an account to enjoy more features like setting up automatic payments, saving payment information for later use and viewing history.

➢ Easy to use online portal to access your account and make payments

➢ Registration is not required

➢ Go Paperless – get your bills via email

➢ Save time with automatic payment options (AutoPay & Recurring Scheduled Payments)

➢ Receive email reminders when your bill is ready, when a scheduled payment is pending, and confirmation after making a payment

➢ Pay by Text – get text notifications about your bill and have the option to pay through your text message with your default payment method (sign up when making an online payment or within your account)

➢ Schedule payments – you may also now have the ability to schedule and set up automatic payments. There are transaction fees charged by our third-party vendor.

Taxpayers who wish to receive their bill electronically via email can do so; all you need to do is visit our website for details on electronic billing and payment information

Along with receiving a paper tax bill in the mail, you will have the opportunity to enroll in paying bills on-line, electronic reminders and notifications, paperless bills and text to pay.

To register for the new opportunities and/or pay your taxes on-line, please refer to link listed above.

Dates to Remember:

2024 pay 2025

Real Estate – February 5, 2025 & July 16, 2025

Mobile Home – March 1, 2025 & July 31, 2025

Prior Tax Due Dates:

2023 pay 2024

Real Estate – February78, July 17

Mobile Home – March 1, July 31

2022 pay 2023

Real Estate – February 8, July 12

Mobile Home – March 1, July 31

2021 pay 2022

Real Estate – February 2, July 13

Mobile Home – March 1, July 29

2020 pay 2021

Real Estate – February 3, July 14

Mobile Home – March 1, July 30